On July 10, 2015, the Royal Decree-Law 9/2015 was approved, featuring urgent measures to reduce the tax burden weighing on taxpayers from the Personal Income Tax (IRPF) and other economic measures.

Following a tax reform designed for gradual implementation in two phases during 2015 and 2016, which came into force last January, this Royal Decree-Law permits the measures scheduled to be introduced in the second phase to be moved forward by six months.

Among other measures, it establishes reductions in tax rates for savings income and work income, allows self-employed workers to reduce their withholdings, and also establishes new exemptions for social aid as well as new measures for the energy sector. Some of these measures are:

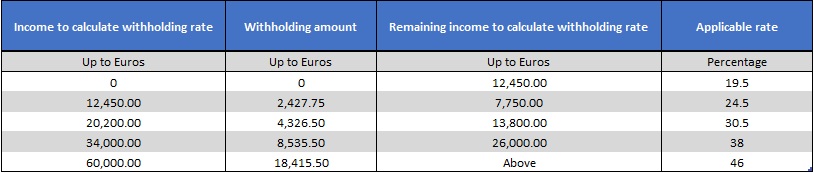

Self-employed workers: new withholding scale, with the minimum rate being 19.5% and the maximum 46% (until July 12 the scale will be the same as since January 1, that is, minimum rate 20%, maximum rate 47%).

Hired workers: the withholding percentage drops for self-employed workers to 15% (instead of 19% as it has been since January 1). Furthermore, the applicable withholding rate or payment on account drops to 7% during the first three years of starting a professional activity.

Savings income: with the new withholding scale, the minimum rate drops to 19.5% and the maximum to 23.5% (before 20% – 24%, respectively).

EMS offers you its vast experience to help with whatever doubts may arise in respect to this new tax modification.

By Sandra Parada – Tax Specialist of EMS